PDF editing your way

Complete or edit your download sar 7 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export getcalfresh sar7 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your calfresh sar 7 form printable form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your can sar 7 form be complete telephonically by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Sar 7

About Form Sar 7

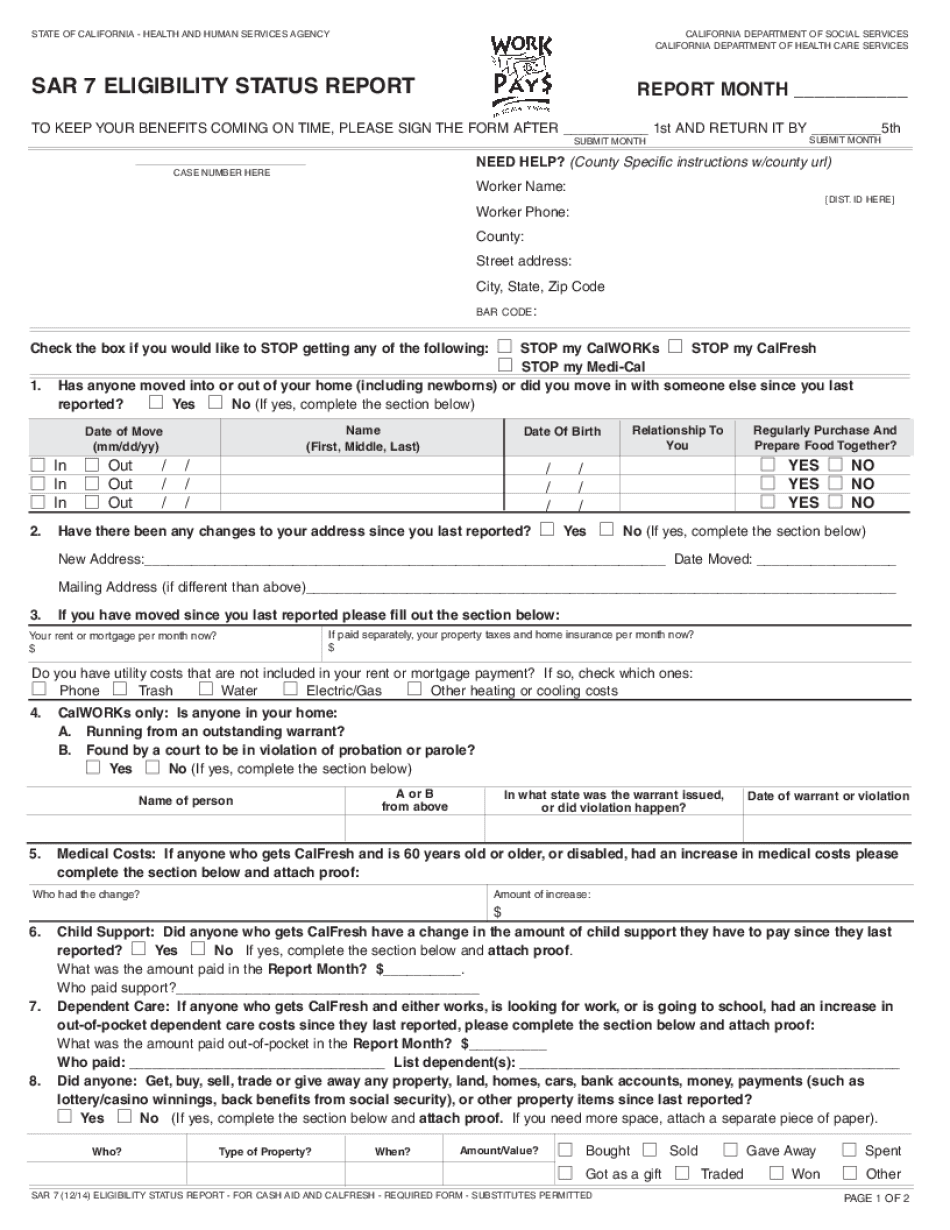

Form SAR 7, also known as the Semi-Annual Report, is a document required by the state of California for individuals and households who are receiving public benefits through the California Work Opportunity and Responsibility to Kids (CalWORKs) or the Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps. It is typically used to report any changes in a recipient's household, income, and expenses that may affect their eligibility or benefit amount. The form collects important information such as employment details, income sources, household members, and any changes in rent or utility payments. Recipients of CalWORKs or SNAP benefits are required to submit Form SAR 7 every six months, providing accurate and updated information. This ensures that the state can accurately assess and determine an individual's eligibility for continued benefits and adjust the amount accordingly. Failing to submit the form on time or providing inaccurate or incomplete information may result in the suspension or termination of benefits. Therefore, it is crucial for those receiving CalWORKs or SNAP benefits to complete and submit Form SAR 7 within the specified deadline to maintain their eligibility.

What Is Sar 7 Form?

Form SAR-7 is an Eligibility Status Report. This form has to be prepared by households who are the participants of CalWorks and CalFresh program.

Such a document is usually completed once a year, i.e. an individual has to fill out this form six months after his/her application and then six months after his/her annual renewal.

An individual is required to report any changes influencing his/her eligibility for cash and services aid and grant amount in semi-annual reporting period.

Remember that information reported in Sar 7 has to be in conformity with information provided in any semy-period reports. Otherwise, a form will be returned to an individual in order to correct the differences. Try to file a form on time in order to avoid any problems with your benefits.

We offer you an up-to-date fillable Sar 7 Form sample that can be easily prepared online. A document may be customized in no time to fit your needs with the help of our various editing tools.

According to a blank form, the following changes have to be reported in a document:

- number of family members (including newborns);

- place of residence;

- amount of support provided;

- employment of any family member;

- other family changes (i.e. marriage, divorce, information about job/employment, details about disabled family members etc.).

A completed document has to be signed by an individual and his / her aided spouse in case of cash aid and by the head of household for CalFresh. You may sign a document electronically by typing, drawing or uploading. A form may be forwarded electronically as well as printed and sent by registered mail. If required, export a document in PDF format to other needed formats.

Online methods make it easier to organize your doc management and enhance the productivity of one's workflow. Carry out the fast tutorial in an effort to comprehensive Form Sar 7, refrain from problems and furnish it in the timely way:

How to finish a Sar 7?

- On the web site with all the sort, simply click Get started Now and pass towards the editor.

- Use the clues to fill out the appropriate fields.

- Include your personal information and call info.

- Make certain that you just enter right info and quantities in suitable fields.

- Carefully examine the material of your kind too as grammar and spelling.

- Refer to assist portion if you've got any problems or handle our Support staff.

- Put an digital signature on your own Form Sar 7 while using the aid of Sign Device.

- Once the form is finished, push Finished.

- Distribute the completely ready kind by means of electronic mail or fax, print it out or conserve in your machine.

PDF editor makes it possible for you to definitely make adjustments on your Form Sar 7 from any net related system, personalize it in line with your requirements, indication it electronically and distribute in various tactics.